BTC Price Prediction: Path to $200,000 Amid Fed Policy Shift and Technical Breakout

#BTC

- Technical Breakout Potential: BTC trading above key moving averages with Bollinger Band expansion suggesting upward momentum toward $118,000 resistance

- Macro Policy Support: Federal Reserve rate cuts creating favorable liquidity conditions for risk assets including Bitcoin

- Institutional Adoption Acceleration: Major corporate treasury allocations and investment vehicle developments providing fundamental support for price appreciation

BTC Price Prediction

Technical Analysis: BTC Shows Bullish Momentum Above Key Moving Averages

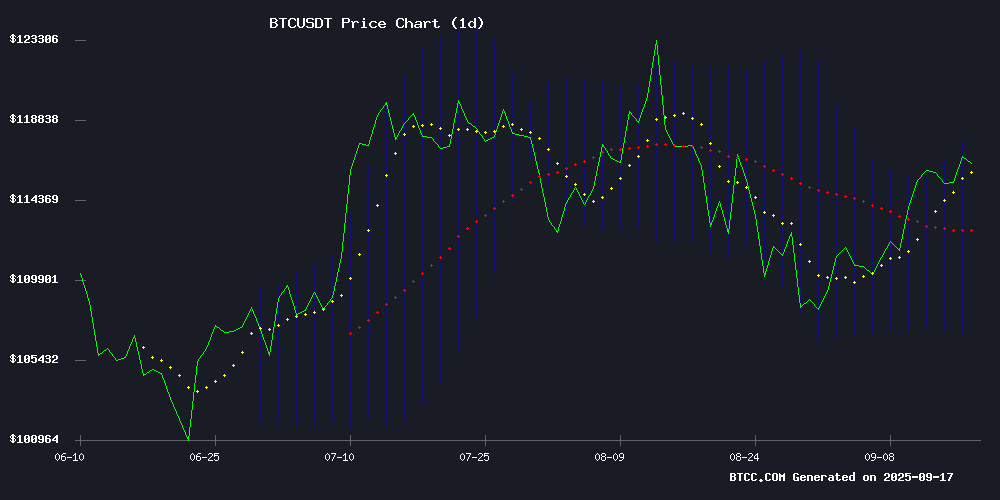

BTC is currently trading at $116,148, comfortably above its 20-day moving average of $112,445, indicating sustained bullish momentum. The MACD reading of -2,547.56 remains in negative territory but shows potential for convergence as the faster line approaches the signal line. The price sits within the Bollinger Band range with upper resistance at $118,083 and lower support at $106,807, suggesting room for upward movement toward the upper band.

According to BTCC financial analyst Robert, 'The technical setup suggests BTC is building strength for a potential breakout. Maintaining above the 20-day MA is crucial for continued upward momentum toward the $118,000 resistance level.'

Market Sentiment: Fed Rate Cut and Institutional Moves Support BTC Outlook

The Federal Reserve's 25 basis point rate cut has created a favorable macro environment for Bitcoin, though the market response has been measured. Significant developments include Metaplanet's $1.4 billion Bitcoin treasury expansion and GameStop holding $528 million in BTC, demonstrating growing institutional confidence.

BTCC financial analyst Robert notes, 'While the immediate price reaction to the Fed cut was muted, the underlying institutional adoption story remains strong. These fundamental developments, combined with technical strength, create a constructive backdrop for Bitcoin's medium-term trajectory.'

Factors Influencing BTC's Price

Fed’s Rate Cut Sparks Debate on Bitcoin Liquidity and Market Maturity

The Federal Reserve's 25-basis-point rate cut, the fourth since September 2024, has ignited discussions on Bitcoin's liquidity and the potential onset of an altcoin season. Policymakers cited concerns over a weakening U.S. labor market, with August job creation plunging to 22,000 from July's 79,000. Average monthly gains have slowed to 29,000, signaling economic stagnation.

The decision wasn't unanimous, with TRUMP appointee Stephen I. Miran advocating for a deeper 50-point cut. Political tensions flared as former President Donald Trump criticized Fed Chair Jerome Powell, labeling him 'Mr. Too Late' and questioning the central bank's independence.

Markets had already priced in the move, with bond yields falling, equities hitting record highs, and Bitcoin briefly reclaiming $115,000. 'Cheaper money typically fuels risk appetite,' noted Coin Bureau CEO Nic Puckrin, though volatility often follows initial reactions. The cut arrives at a critical juncture for crypto markets, with traders watching for sustained momentum in BTC and altcoins.

Crypto Markets Show Muted Response to Fed Rate Cut and Powell's Cautious Tone

Federal Reserve Chair Jerome Powell delivered a anticipated quarter-point rate cut while maintaining a conservative stance, citing 'evolving' policy impacts and economic uncertainties. The crypto market's tepid reaction reflects Powell's careful balancing act between inflation control and employment concerns.

Bitcoin's price action mirrored the broader digital asset market's indifference, with BTC showing minimal volatility during the Fed announcement. Powell's explicit dismissal of political influence on monetary policy marked a departure from his typically diplomatic approach.

The FOMC's decision to continue balance sheet reduction suggests lingering concerns about inflationary pressures, creating headwinds for risk assets. Market participants appear to be looking beyond this telegraphed move, with crypto prices remaining range-bound despite the macroeconomic developments.

Bitcoin Price Reaction to Fed Rate Cut Sparks Market Speculation

Bitcoin dipped 0.7% to $115,930 as markets processed the Federal Reserve's first rate cut in nearly a year. The 25 basis point reduction brings the target range to 4.00%-4.25%, a defensive MOVE Chair Powell framed as "risk management" amid cooling job growth and persistent inflation.

The Fed's updated projections paint a cautious outlook: 1.6% GDP growth for 2025, unemployment rising to 4.5%, and inflation gradually easing to 2% by 2028. Powell's remarks initially calmed markets, but volatility surged during his press conference—revealing underlying tensions between policy easing and economic uncertainty.

Technical indicators suggest brewing pressure. Bitcoin's rising wedge formation signals fading bullish momentum, with traders now watching whether the Fed's dovish tilt can reignite the cryptocurrency's dual role as both risk asset and inflation hedge. The wedge failure at current levels raises questions about a potential retest of support.

Fed's Rate Cut Triggers Bitcoin Volatility, Experts Predict Crypto Rally

The Federal Reserve's 25 basis point rate cut sent immediate ripples through cryptocurrency markets, with Bitcoin briefly dipping below $115,000. The move marks the first reduction in borrowing costs this year as policymakers attempt to navigate persistent inflation and a cooling labor market.

Fed Chair Jerome Powell acknowledged progress on inflation but emphasized the 2% target remains elusive. The central bank's updated projections suggest rates could fall to 3.5-3.75% by 2025, with two additional cuts anticipated in 2024. "We're seeing the money printer getting turned on," noted crypto analyst Lark Davis, predicting capital inflows will ultimately benefit digital assets despite short-term volatility.

Market observers now watch for whether the anticipated liquidity injection will fulfill crypto bulls' expectations of renewed rallies. The Fed's dovish pivot comes as bitcoin continues to demonstrate its sensitivity to macroeconomic policy shifts, reinforcing its growing correlation with traditional risk assets.

Bitcoin Surges Toward $117,000 Amid Binance Outflows

Bitcoin has rebounded to $117,000 as on-chain data reveals sustained withdrawals from Binance, the world's largest cryptocurrency exchange by volume. The trend signals accumulation by investors, a bullish indicator for BTC's price trajectory.

Exchange Netflow metrics show nine consecutive days of negative balances for Binance, with more Bitcoin leaving the platform than entering. Historically, such outflows correlate with reduced selling pressure and potential price appreciation.

The movement coincides with Bitcoin's recovery surge, suggesting holders are opting for self-custody solutions rather than exchange-based liquidation. Market analysts interpret this as institutional confidence building ahead of anticipated macroeconomic shifts.

VanEck Ventures into Stablecoins and Tokenization, Building on Legacy of Financial Innovation

VanEck, the Wall Street firm behind pioneering Gold funds and one of the first spot Bitcoin ETFs, is now turning its attention to stablecoins and tokenization. Juan C. Lopez, General Partner at VanEck Ventures, frames the firm's strategy as an evolution of financial instruments—from seashells to on-chain assets. "You could even joke that VanEck’s first Gold mutual funds were the original ‘tokenized gold,’" Lopez told BeInCrypto.

The firm’s venture arm is focusing on three Core questions: accelerating stablecoin adoption, identifying use cases for widely distributed stablecoins, and exploring new asset classes enabled by advanced market infrastructure. While stablecoins dominate current discussions, VanEck’s approach remains broad, targeting the next phase of crypto infrastructure development.

Bitcoin Rises as US Federal Reserve Opts for 25bps Rate Cut

Bitcoin's price surged following the US Federal Reserve's decision to cut interest rates by 25 basis points, marking the first reduction in nine months. The Federal Open Market Committee lowered the benchmark federal funds rate to a range of 4.00% to 4.25%, aligning with market expectations. This move, widely anticipated by economists and traders, reflects moderated economic growth and elevated inflation concerns.

The rate cut signals lower borrowing costs for consumers, potentially fueling demand for risk assets like cryptocurrencies. However, it also raises questions about the Fed's inflation management and policy independence. Market sentiment, as gauged by Polymarket, had overwhelmingly priced in the 25bps cut, with 93% of participants predicting the outcome.

Fed officials emphasized a data-dependent approach to future rate adjustments, noting they WOULD carefully assess economic indicators. The decision comes amid slowing job growth and persistent inflation, creating a complex backdrop for monetary policy and digital asset markets.

Metaplanet Raises $1.4 Billion to Expand Bitcoin Treasury Holdings

Metaplanet, Japan's leading Bitcoin treasury firm, has secured $1.4 billion through an upsized international share offering, marking one of the largest corporate Bitcoin acquisitions in recent history. The Tokyo-listed company's aggressive fundraising underscores growing institutional confidence in Bitcoin as a strategic reserve asset, even amid fluctuating crypto market sentiment.

The share offering was dramatically increased from an initial target of $180 million to $385 million, with shares priced at approximately $3.75. This bold move reflects strong investor belief in Metaplanet's Bitcoin-centric business model, despite current market volatility. Nearly JPY 183.7 billion of the proceeds will be allocated to Bitcoin purchases between September and October 2025, significantly boosting the company's existing holdings of 20,000 BTC (valued at JPY 322 billion as of September 2025). Remaining funds will support Bitcoin-related operations through December 2025.

The offering comes with substantial dilution, effectively doubling Metaplanet's outstanding shares. This strategic play demonstrates how corporations are increasingly viewing Bitcoin not just as a speculative asset, but as a CORE component of long-term treasury management strategies.

US Fed Slashes Interest Rates by 25 BPS: Bitcoin's Muted Reaction

The US Federal Reserve cut interest rates by 25 basis points, aligning with market expectations. Bitcoin's price reaction remained subdued, trading around $116,000 shortly after the announcement.

Analysts suggest the muted response indicates the rate cut was already priced in following Jerome Powell's earlier hints at Jackson Hole. BTC had briefly surged to $117,200 before the announcement but quickly retreated.

The cryptocurrency market's calm reaction contrasts with its August rally, when Powell's dovish signals sparked significant gains. All eyes now turn to whether this stability persists in coming days.

GameStop Holds $528M in Bitcoin Amid Quarterly Losses, Sparks Market Interest

GameStop's latest financial disclosures reveal a strategic $528 million Bitcoin position that softened an $18.5 million quarterly loss. The gaming retailer's 4,710 BTC acquisition now shows $28.6 million in unrealized gains as Bitcoin climbed 18% since purchase—a treasury hedge outperforming traditional assets during declining hardware sales.

While net sales dropped to $674 million with slowing console demand, collectibles revenue surged 63% through publisher partnerships. The BTC reserve, valued via Coinbase pricing, aligns GameStop with corporations treating cryptocurrency as a balance sheet asset. Shares briefly jumped 7% post-announcement before settling at a flat yearly trajectory.

Bitcoin’s Price Recovery Revives Profit Margins For Short-Term Whales

Bitcoin's resurgence above the $117,000 mark has reignited bullish sentiment, confirming the endurance of the current market cycle. On-chain data reveals a notable shift: short-term holder whales are back in profit territory, signaling renewed confidence among recent major players.

Market analyst Darkfost highlights this pivotal development. After weathering September's minor downturn, these whales now defend a critical price zone between $108,000 and $117,000. Their regained profitability often precedes momentum shifts, making this a key indicator for BTC's trajectory.

The rapid mood swing among short-term whales underscores crypto markets' volatility. As these influential players return to green, their activity may catalyze broader market movements—a pattern historically preceding extended rallies.

Will BTC Price Hit 200000?

Based on current technical indicators and fundamental developments, reaching $200,000 represents a significant but achievable target for BTC in the medium to long term. The combination of supportive Federal Reserve policy, growing institutional adoption, and strong technical positioning above key moving averages creates a favorable environment.

| Metric | Current Value | Target | Growth Required |

|---|---|---|---|

| Current Price | $116,148 | $200,000 | 72.2% |

| 20-Day MA Support | $112,445 | - | - |

| Bollinger Upper | $118,083 | - | - |

While short-term volatility is expected, the convergence of technical strength and positive fundamental catalysts suggests the $200,000 level is within reach, though timing remains dependent on broader market conditions and continued institutional inflows.